Fuel Expenses Direct Or Indirect . for accounting purposes, direct costs are always factored into your cost of goods sold, while indirect costs. businesses study the direct expenses to calculate their gross profit. a direct cost is a cost that can be associated directly with a cost object. expenses are amounts paid for goods or services purchased. Also, the impact of direct expense on a. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. direct expenses usually appear on the debit side of the trading account. They can either be directly or indirectly related to the core. much like direct costs, indirect costs can be fixed or variable. What are examples of indirect costs?. An indirect cost is a cost that cannot be easily associated with a cost object. On the contrary, indirect expenses are shown on the debit side of the profit and loss. Fixed indirect costs include expenses such as rent;

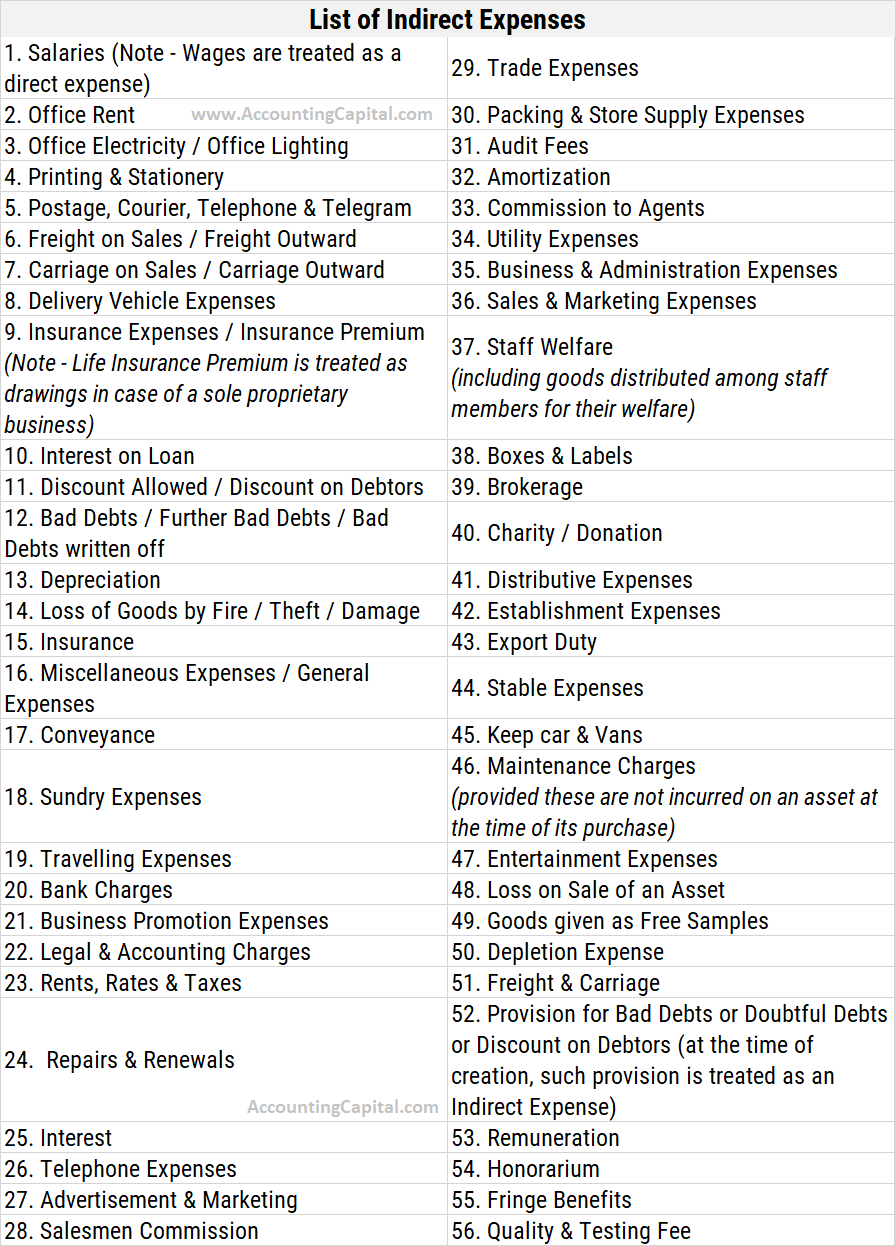

from www.accountingcapital.com

businesses study the direct expenses to calculate their gross profit. direct expenses usually appear on the debit side of the trading account. Fixed indirect costs include expenses such as rent; a direct cost is a cost that can be associated directly with a cost object. much like direct costs, indirect costs can be fixed or variable. What are examples of indirect costs?. They can either be directly or indirectly related to the core. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. for accounting purposes, direct costs are always factored into your cost of goods sold, while indirect costs. An indirect cost is a cost that cannot be easily associated with a cost object.

List of Indirect Expenses (with PDF) Accounting Capital

Fuel Expenses Direct Or Indirect On the contrary, indirect expenses are shown on the debit side of the profit and loss. for accounting purposes, direct costs are always factored into your cost of goods sold, while indirect costs. direct expenses usually appear on the debit side of the trading account. An indirect cost is a cost that cannot be easily associated with a cost object. What are examples of indirect costs?. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. Fixed indirect costs include expenses such as rent; much like direct costs, indirect costs can be fixed or variable. expenses are amounts paid for goods or services purchased. They can either be directly or indirectly related to the core. businesses study the direct expenses to calculate their gross profit. On the contrary, indirect expenses are shown on the debit side of the profit and loss. Also, the impact of direct expense on a. a direct cost is a cost that can be associated directly with a cost object.

From tutorstips.com

Direct and Indirect Expenses Differences TutorsTips Fuel Expenses Direct Or Indirect businesses study the direct expenses to calculate their gross profit. Also, the impact of direct expense on a. They can either be directly or indirectly related to the core. On the contrary, indirect expenses are shown on the debit side of the profit and loss. An indirect cost is a cost that cannot be easily associated with a cost. Fuel Expenses Direct Or Indirect.

From www.etsy.com

Fuel Cost Tracker Printable, Fuel Expense Tracker, Car Fuel Tracker Fuel Expenses Direct Or Indirect much like direct costs, indirect costs can be fixed or variable. expenses are amounts paid for goods or services purchased. What are examples of indirect costs?. Fixed indirect costs include expenses such as rent; businesses study the direct expenses to calculate their gross profit. for accounting purposes, direct costs are always factored into your cost of. Fuel Expenses Direct Or Indirect.

From www.template.net

Fuel Cost Log Template in Excel, Google Sheets Download Fuel Expenses Direct Or Indirect expenses are amounts paid for goods or services purchased. businesses study the direct expenses to calculate their gross profit. What are examples of indirect costs?. They can either be directly or indirectly related to the core. An indirect cost is a cost that cannot be easily associated with a cost object. On the contrary, indirect expenses are shown. Fuel Expenses Direct Or Indirect.

From www.vrogue.co

What Is The Difference Between Direct And Indirect Co vrogue.co Fuel Expenses Direct Or Indirect much like direct costs, indirect costs can be fixed or variable. They can either be directly or indirectly related to the core. On the contrary, indirect expenses are shown on the debit side of the profit and loss. a direct cost is a cost that can be associated directly with a cost object. Also, the impact of direct. Fuel Expenses Direct Or Indirect.

From www.fuelcardservices.com

What do you need to know about claiming fuel expenses? Fuel Expenses Direct Or Indirect On the contrary, indirect expenses are shown on the debit side of the profit and loss. Also, the impact of direct expense on a. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. Fixed indirect costs include expenses such as rent; An indirect cost is a. Fuel Expenses Direct Or Indirect.

From www.youtube.com

Direct Expenses and Indirect expenses under Accounting must Fuel Expenses Direct Or Indirect a direct cost is a cost that can be associated directly with a cost object. direct expenses usually appear on the debit side of the trading account. Also, the impact of direct expense on a. Fixed indirect costs include expenses such as rent; On the contrary, indirect expenses are shown on the debit side of the profit and. Fuel Expenses Direct Or Indirect.

From fundamentalsofaccounting.org

What are Direct Expenses in Costing? Fundamentals of Accounting Fuel Expenses Direct Or Indirect Fixed indirect costs include expenses such as rent; expenses are amounts paid for goods or services purchased. What are examples of indirect costs?. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. businesses study the direct expenses to calculate their gross profit. for. Fuel Expenses Direct Or Indirect.

From www.accountingcapital.com

List of Indirect Expenses (with PDF) Accounting Capital Fuel Expenses Direct Or Indirect Fixed indirect costs include expenses such as rent; They can either be directly or indirectly related to the core. a direct cost is a cost that can be associated directly with a cost object. Also, the impact of direct expense on a. expenses are amounts paid for goods or services purchased. An indirect cost is a cost that. Fuel Expenses Direct Or Indirect.

From pmstudycircle.com

Direct Cost Vs Indirect Cost in Project Management PM Study Circle Fuel Expenses Direct Or Indirect direct expenses usually appear on the debit side of the trading account. An indirect cost is a cost that cannot be easily associated with a cost object. Also, the impact of direct expense on a. much like direct costs, indirect costs can be fixed or variable. What are examples of indirect costs?. indirect costs, or overheads, are. Fuel Expenses Direct Or Indirect.

From efinancemanagement.com

Types of Costs Direct & Indirect Costs Fixed & Variable Costs eFM Fuel Expenses Direct Or Indirect They can either be directly or indirectly related to the core. expenses are amounts paid for goods or services purchased. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. much like direct costs, indirect costs can be fixed or variable. On the contrary, indirect. Fuel Expenses Direct Or Indirect.

From haydennewsatkins.blogspot.com

Explain the Differences Between the Direct and the Indirect Method Fuel Expenses Direct Or Indirect What are examples of indirect costs?. On the contrary, indirect expenses are shown on the debit side of the profit and loss. much like direct costs, indirect costs can be fixed or variable. Also, the impact of direct expense on a. Fixed indirect costs include expenses such as rent; a direct cost is a cost that can be. Fuel Expenses Direct Or Indirect.

From www.collidu.com

Direct and Indirect Costs PowerPoint and Google Slides Template PPT Fuel Expenses Direct Or Indirect They can either be directly or indirectly related to the core. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. direct expenses usually appear on the debit side of the trading account. Also, the impact of direct expense on a. a direct cost is. Fuel Expenses Direct Or Indirect.

From blog.workful.com

Direct vs. Indirect Expenses What’s the Difference? [Infographic Fuel Expenses Direct Or Indirect for accounting purposes, direct costs are always factored into your cost of goods sold, while indirect costs. They can either be directly or indirectly related to the core. a direct cost is a cost that can be associated directly with a cost object. much like direct costs, indirect costs can be fixed or variable. Also, the impact. Fuel Expenses Direct Or Indirect.

From www.teachoo.com

What are Direct Indirect Expense Understanding Direct Indirect Expen Fuel Expenses Direct Or Indirect expenses are amounts paid for goods or services purchased. What are examples of indirect costs?. indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. On the contrary, indirect expenses are shown on the debit side of the profit and loss. for accounting purposes, direct. Fuel Expenses Direct Or Indirect.

From profitbooks.net

Direct And Indirect Expenses Understand The Difference With Examples Fuel Expenses Direct Or Indirect expenses are amounts paid for goods or services purchased. Fixed indirect costs include expenses such as rent; indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. They can either be directly or indirectly related to the core. businesses study the direct expenses to calculate. Fuel Expenses Direct Or Indirect.

From www.patriotsoftware.com

What's the Difference Between Direct vs. Indirect Costs? Fuel Expenses Direct Or Indirect for accounting purposes, direct costs are always factored into your cost of goods sold, while indirect costs. businesses study the direct expenses to calculate their gross profit. What are examples of indirect costs?. direct expenses usually appear on the debit side of the trading account. An indirect cost is a cost that cannot be easily associated with. Fuel Expenses Direct Or Indirect.

From workful.com

Direct vs. Indirect Expenses What’s the Difference? [Infographic Fuel Expenses Direct Or Indirect indirect costs, or overheads, are operating expenses that are not directly traceable to a single product, service or other specific cost object. much like direct costs, indirect costs can be fixed or variable. They can either be directly or indirectly related to the core. An indirect cost is a cost that cannot be easily associated with a cost. Fuel Expenses Direct Or Indirect.

From khatabook.com

Understand What Are Direct Expenses And Indirect Expenses Fuel Expenses Direct Or Indirect direct expenses usually appear on the debit side of the trading account. businesses study the direct expenses to calculate their gross profit. a direct cost is a cost that can be associated directly with a cost object. for accounting purposes, direct costs are always factored into your cost of goods sold, while indirect costs. Fixed indirect. Fuel Expenses Direct Or Indirect.